SWKPLNT (5135) - Highest Upside Plantation stock [$$bill]

Stock symbol: SWKPLNT

Stock code: 5135

Share price: RM2.98 (18 Feb 2022 closing price)

Shares outstanding: 279.03mil

Market cap: RM831.5mil

A rising tide lifts all boats... but which is the best boat to ride in?

It's almost been a year since my last write up on Sarawak Plantation Bhd / SWKPLNT (5135). Including dividends, the stock has since returned 57% (up to 18 Feb closing price).

I thought it would be good to do a quick write up to clarify my own thoughts.

First of all, what are the major themes in the stock market now? Two definite ones are:

(1) Surging inflation

(2) Rotation from growth to value stocks

Given (1) and (2), SWKPLNT seems to be in a sweet spot...

Inflation

Research shows that commodity and commodity stocks outperform during inflationary periods. Within the commodity space, crude palm oil (CPO) have been performing wonderfully and prices are expected to remain elevated driven by strong fundamental factors

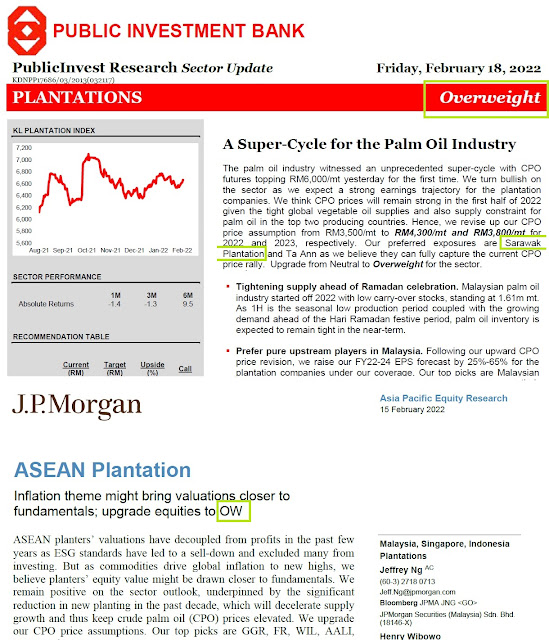

Foreign brokers are turning bullish while some local brokers have switched to an overweight stance on the plantation sector recently.

Rotation to value stocks

The other major theme is the rotation from growth (like tech stocks) to value stocks on the backdrop of rising rates (negative for valuations of high growth stocks).

SWKPLNT trades at around 6x P/E and offers a dividend yield of 5%, making it an attractive value stock.

But what makes it an even more attractive value stock is its Enterprise Value per Planted Hectare (EV/ha).

I believe many investors have not picked up on this angle when looking at SWKPLNT.

*EV is important because it gives a truer picture of the market value of a company as it takes into account the debt and cash. Looking at market cap alone doesn't say much.

SWKPLNT has an EV/ha of RM22,873.

EV = market cap + total debt - cash = RM831.5mil + RM74.2mil – RM122.8mil = RM782.3mil

Planted plantation area = 34,226 ha

EV/ha = RM22,873

*note that EV/ha uses planted area, not total landbank (as empty land is not productive).

Similar plantation stocks easily trade at 2-3x more than this.

Even J.P. Morgan recently switched its valuation methodology for plantation stocks from P/E to EV/ha. JP Morgan price targets on plantation stocks are based on EV/ha of US$25,000/ha (RM105,000/ha) for plantation land in Malaysia (while Indonesia plantation estates are valued lower at US$14k/ha).

Example of how JP Morgan values Sime Darby Plantation Bhd and First Resources Ltd (listed in Singapore):

SWKPLNT's plantation land bank are all located in Malaysia, which carries a premium over Indonesia land bank.

What would SWKPLNT be worth if valued using EV/ha of RM105k/ha?

If the JP Morgan approach is used, SWKPLNT would be valued at RM13.03! Even if a 50% discount is applied, SWKPLNT is still worth RM6.52. To illustrate:

On hindsight, I might have been early to enter but it was a worthwhile wait with SWKPLNT paying handsome dividends along the way.

However, it appears that the time has come for this stock to soar as the plantation rally grows stronger and more investors start to discover the true upside potential of SWKPLNT (5135).

Disclaimer: All information here reflects the author’s personal views/thoughts and should not be considered as investment advice. It is very important to do your own analysis before making any investment based on your own personal circumstances. No content here constitutes - or should be understood as constituting - a recommendation to enter in any securities transactions.

Comments

Post a Comment