SARAWAK PLANTATION (SWKPLNT) – a horse with latent potential + the right jockey = a CHAMPION racehorse

SARAWAK PLANTATION (SWKPLNT) – a horse with latent potential + the right jockey = a CHAMPION racehorse

Stock symbol: SWKPLNT (5135)

Stock price: RM1.99

Market cap: RM555.27mil

Shares outstanding: 279.03mil

Part 1: A horse with huge latent potential

CPO prices have been bullish, recently breaching the RM4,000/tonne mark for the 2nd time in 3 months.

A number of positive factors will continue to drive and support CPO prices.

But why are most plantation stocks not rallying?

That’s because they are trading at expensive valuations of around 30x P/E with low production growth of only of 3-6%, while some even have negative production growth.

However, there is an exception…

One rare species.

One with double-digit production growth and an attractive single-digit P/E.

This jewel is little-known Sarawak Plantation Bhd (SPB), an undervalued company with explosive earnings growth.

SPB is a pure-play Sarawak-based upstream plantation company. As of end-2019, its total landbank stood at 45,668ha with a total planted area of 35,076ha.

SPB has its prime superior conditions in terms of good landbank which, in turn, offers a strategic logistic advantage that is hard to find elsewhere in Sarawak (click here for location map).

Part 2: The right jockey

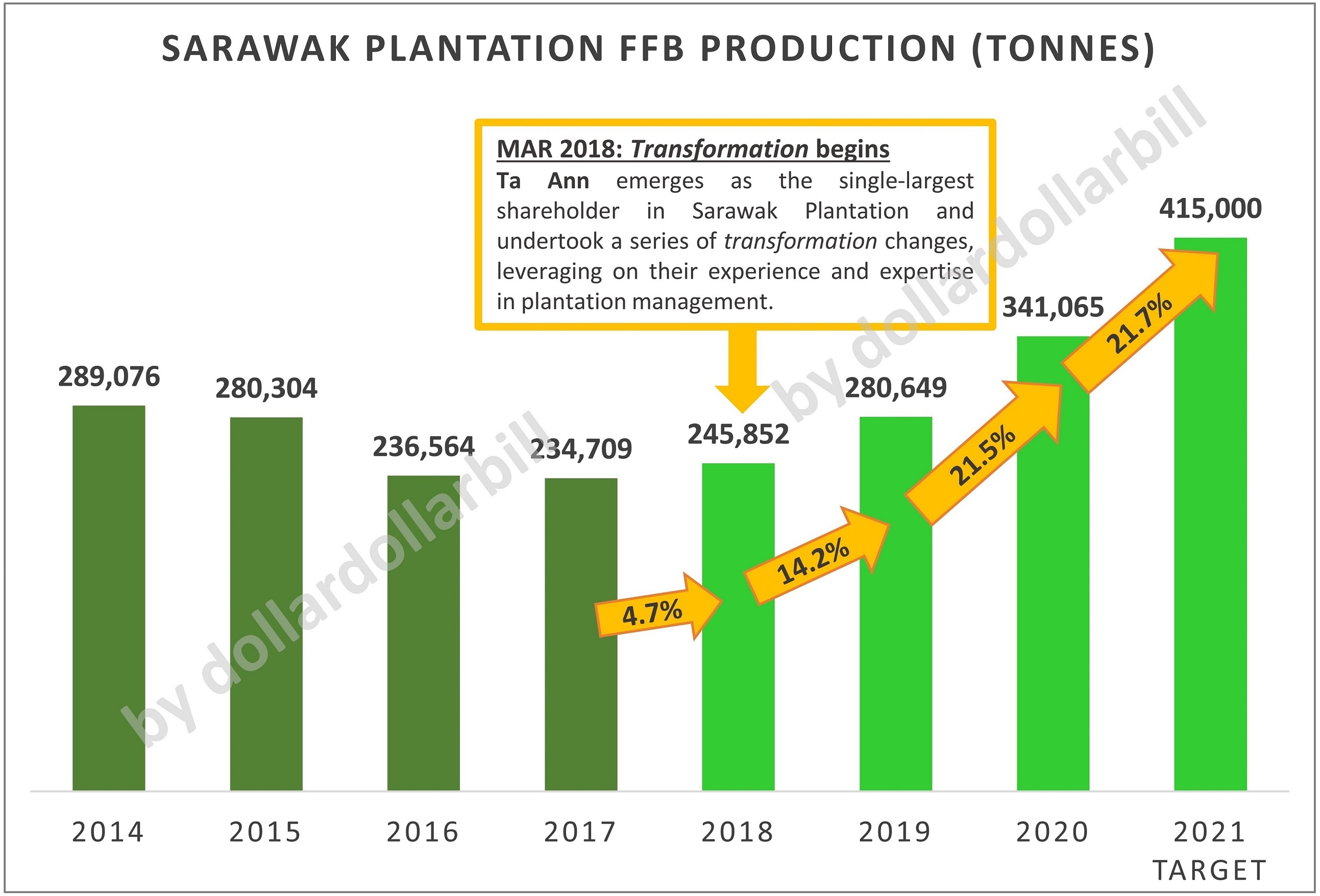

SPB had undergone a massive transformation and reformation after Ta Ann Holdings Bhd emerged as a controlling shareholder in Mar 2018.

After acquiring a 30.4% stake in SPB for RM170mil (or RM2.00/share), Ta Ann brought in its highly capable and experienced management team to turn around SPB.

Before Ta Ann, FFB production was on a declining trend largely due to poor management. Following the entry of Ta Ann, spearheaded by CEO Datuk Wong Kuo Hea (who was also appointed executive director of SPB on 28 Mar 2018), SPB witnessed various changes across the board.

The new management’s main goal: to increase productivity and efficiency.

Focus was placed on automation and mechanization of SPB mills and estate operations. New machineries were brought in to improve productivity for mineral land plantation. More resources were pumped in along with technical know-how transferred from Ta Ann.

After two years of continuous hard work, SPB is starting to see the full results.

Source: annual reports, analyst reports, SPB website

Since the entry of Ta Ann’s management, FFB production has increased by more than 40%!

Without a doubt, the right management makes a huge difference to the success of a business, as Charlie Munger (legendary billionaire investor and partner of Warren Buffett at Berkshire Hathaway) said:

This is just the beginning…

Ta Ann's CEO Datuk Wong has big plans for SPB. He wants to transform SPB into one of the plantation industry leaders (click here for the full story).

“I have full confidence in transforming SPB into one of the plantation industry leaders.”

– Datuk Wong Kuo Hea, Ta Ann group CEO

Going into 2021, SPB’s management is targeting FFB production to grow by 21% to 415,000 tonnes on the back of yield improvement.

Part 3: Very favourable winning odds

SPB has one of the most solid balance sheets in the plantation sector with a low net gearing ratio of 0.01x.

SPB has been generous in paying dividends. In 2020, a total of 10 sen in dividends were paid (two interim dividends of 5 sen), translating into a dividend yield of 5.0%.

Valuation wise, SPB is trading below 10x trailing P/E, making it one of the most undervalued plantation stocks in Malaysia. On average, plantation stocks are trading at around 30x P/E.

As a pure upstream plantation company, SPB's earnings is highly sensitive to CPO price movements. Every RM100/tonne increase in CPO price will result in SPB's net profit increasing by RM7-8mil (according to a report by Public Investment Bank Research).

In 2020, SPB posted a net profit of RM61mil with average realised CPO price of RM2,700/tonne.

CPO prices are currently hovering close to RM4,000/tonne!

If CPO prices averages RM3,200/tonne this year, SPB will see an extra net profit of RM35-40mil in 2021.

Note that this additional profit is purely from CPO price movement. This has not factored in the 21% growth in FFB production targeted by management. A 10% growth in FFB production will contribute an additional RM14mil to net profit (according to Public Investment Bank Research).

Even if CPO price averages RM2,800/tonne, SPB should record double-digit net profit growth.

Clearly, there is a huge mismatch between SPB's fundamentals and market valuation.

To put it another way, SPB stock is trading at around 2018 levels, when Ta Ann management came in at RM2.00/share. But since then (from 2018 to 2020), production has grown by more than 40%. The new management has grown revenue by 50% to RM466mil and net profit by more than 5x to RM61mil.

SPB is a different company today than it was two years ago.

The new management has transformed SPB into a more productive company with growing cashflows. Dividends have doubled from RM14mil to RM28mil. A strong foundation has been built and this is just the beginning.

How do you justify paying less than 8x forward P/E for a company growing at 15-20%?

Even at 5-10% growth, it is unjustifiable. Note that most mature plantation companies are trading around 30x trailing P/E while growing at only 3-6%.

It is only a matter of time before more investors realise the full potential of SPB. Until then, savvy investors who discovers this gem early will be riding on the full upside of the stock.

Join my Telegram channel for random updates @worthystocks

#SWKPLNT

Comments

Post a Comment