PBA Holdings Bhd: (P)rofits to (B)ecome (A)bundant?

"When the well is dry, we learn the worth of water" - Benjamin Franklin

Is there a high chance of water tariff increases for domestic users in Penang, and what could be the potential earnings boost for PBA?

Fresh news on domestic water tariff hikes sparked interest in PBA on Tuesday (26 Dec), with the stock rising 13% to close at RM1.30. Recall that last month, PBA hit limit up (+30sen) to close at RM1.12 on 8 Nov after unveiling stellar 3Q23 results.

To recap, higher tariff rates for non-domestic users in Penang were implemented on 1 Jan 2023. This along with lower energy costs contributed to PBA achieving its best-ever quarterly pre-tax profit of RM29.1m in 3Q23. Due to the recognition of deferred tax assets on unutilized reinvestment allowances (RA)*, 3Q23 PAT was higher at RM36.8m.

*In PBA’s 3Q notes, it stated that as of 30 Sep 2023, it is anticipated that RM275m out of the RM698m of unutilized reinvestment allowances available will be utilized to set off against future taxable profits. The unutilized RA arising during the special RA period is allowed to be carried forward for 7 consecutive YAs from YA 2025 until YA 2031.

Based on 3Q23 results, an average PAT of RM25m a quarter or RM100m a year seems quite achievable.

The potential impact of domestic tariff increases

PBA said it absorbed RM103.7m in domestic water consumption subsidies in 2022, as it was supplying water below its cost of production. If average tariffs for domestic consumers can be raised to OPEX levels, that would be equivalent to a RM100m boost to its bottom line.

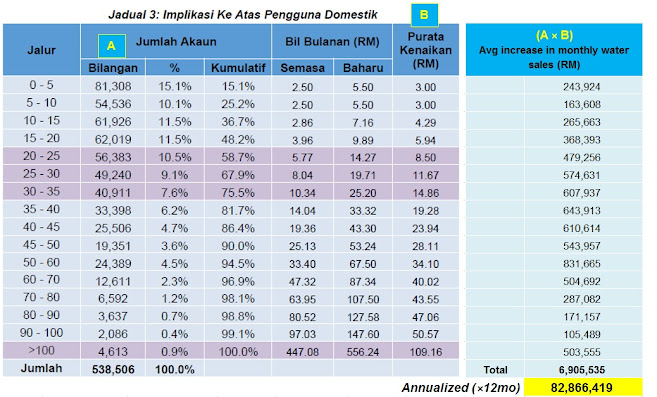

To assess the viability of the RM100m boost, I benchmarked the numbers by extrapolating data from PBA's 2021 consultation paper with SPAN.

The 2021 consultation paper provided a useful breakdown of the number of consumers based on their monthly water usage. It also showed the impact on monthly water bills if the new tariffs were implemented.

Using the data in the table below (Jadual 3), if we take the average increase in monthly bills and multiply that by the number of users in each usage range bracket, adding them up would result in a monthly increase in water revenue of RM6.9m or RM82.9m a year for PBA.

Back then, the rates they were seeking are as in the below table (Jadual 2). The suggested new tariffs seem very reasonable and would bring them close to Selangor’s current rates.

What could the stock potentially be worth?

With a current share price of RM1.30 and 331m shares outstanding, PBA’s market cap is at RM430m.

As discussed earlier, achieving annual earnings of RM100m seem feasible based on its 3Q23 performance. The revised domestic water tariffs might contribute an additional RM80m-RM100m. To err on the side of caution and provide a buffer, let’s just say an additional RM50m. So, the new earnings base for PBA could be RM150m. Applying a conservative P/E ratio of 6x, PBA could be valued at RM900m or RM2.72 per share. However, given its monopoly status and its position in a non-cyclical sector with inelastic demand, a higher P/E ratio of 7-8x seems fair. If PBA is valued at 7-8x P/E, its potential worth could range from RM1.05bn to RM1.2bn, translating to a per-share value of RM3.17 to RM3.63.

With higher earnings, a subsequent increase in dividends is likely, providing support to the stock.

It's worth noting that PBA boasts a robust net cash position of RM193m as of 30 Sep 2023, with cash reserves of RM213m against total borrowings of RM20m. PBA's book value stands at RM953.6m or RM2.88 per share.

Is there a high chance for domestic tariff adjustments?

PBA, along with other state water operators, is not seeking a tariff review merely for profits but to fund projects that mitigate the risk of raw water shortages and improve water supply services.

Based on the news flow this year concerning water tariffs, there appears to be a high chance of tariff increases in 2024. Most news suggests that the government is committed to addressing issues and ensuring the sustainability of water supply. Recognizing that water tariffs in the country have been too low, there is a crucial need for an increase to sustain the water sector and prevent a water crisis.

In Penang, water tariffs for domestic consumers are the lowest in the country, averaging 32 sen per 1,000 litres for the first 35,000 litres per month.

For perspective, my monthly water usage in my Klang Valley household, about 30 cubic meters (30,000 litres), costs RM21. In Penang, the equivalent usage would only cost RM9.

Given Penang's current status with the lowest domestic water tariffs, there's a strong likelihood that PBA will secure the tariff adjustments it seeks. Additionally, other states, despite having higher tariff rates, are also pursuing revisions for the domestic sector.

Adding to this narrative, recent social media content from SPAN (Instagram account: www.instagram.com/span_malaysia), indicate a strategic effort to familiarize domestic consumers with the possibility of upcoming water tariff hike. The posts focus on explaining the importance of such adjustments and provide a rationale for the hike. Take a look:

- [SPAN Instagram Reel 1] (https://www.instagram.com/reel/C1WJcbYpQ_s)

- [SPAN Instagram Reel 2] (https://www.instagram.com/reel/C1Gv1buJeR2)

- [SPAN Instagram Reel 3] (https://www.instagram.com/reel/C00OjSip6AY/)

For random updates and more, feel free to join my Telegram channel. Check it out @worthystocks: https://t.me/worthystocks

Disclaimer: All information here reflects the author’s personal views/thoughts and should not be considered as investment advice. It is very important to do your own analysis before making any investment based on your own personal circumstances. No content here constitutes - or should be understood as constituting - a recommendation to enter in any securities transactions.

Comments

Post a Comment