Sunway Bhd (5211) – Healthcare re-rating [$$bill]

Sunway Bhd (5211) – Healthcare re-rating

Sunway could see some upside if research houses start raising the valuation of its healthcare business.

Bloomberg reported today that Sunway is looking to sell a 20-25% stake in its healthcare unit that could fetch at least USD250 mil.

That means:

If a 20% stake is worth USD250 mil, 100% stake is worth USD1.25 bil.

If a 25% stake is worth USD250 mil, 100% stake is worth USD1 bil.

USD1 bil is about RM4.15 bil.

That is much higher than the valuations given by some research houses, such as:

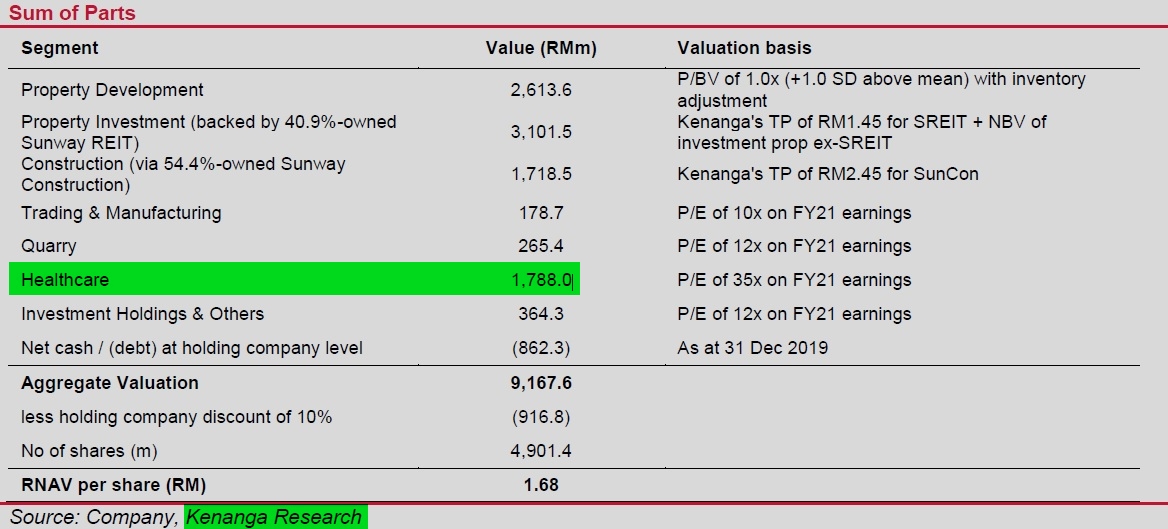

Kenanga IB: RM1,788 mil

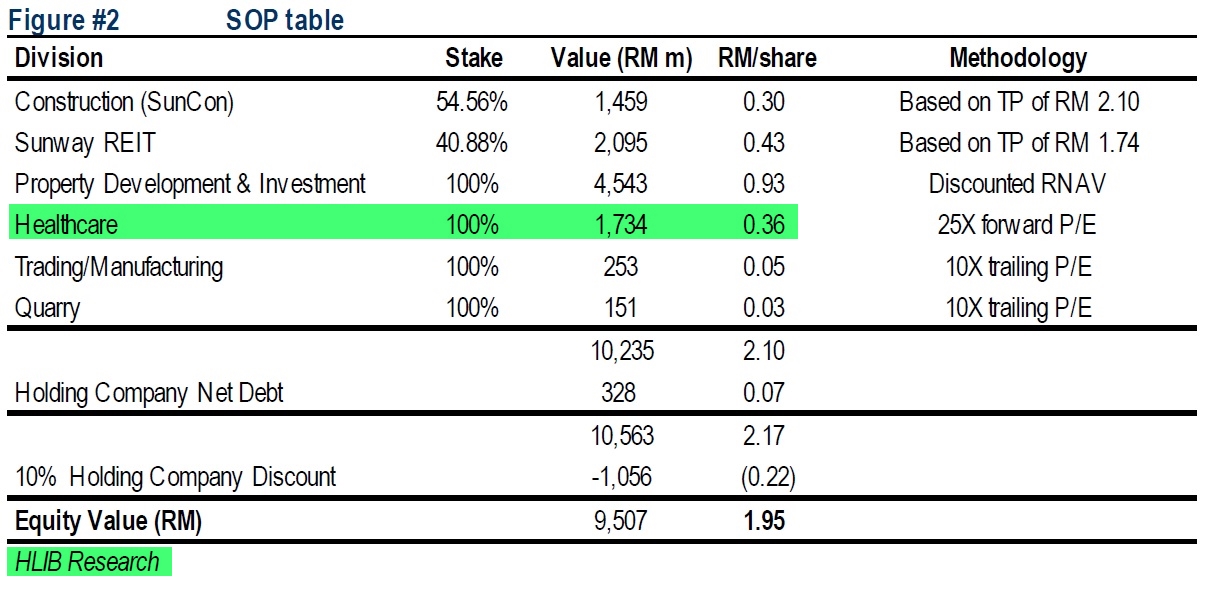

Hong Leong IB: RM1,734 mil

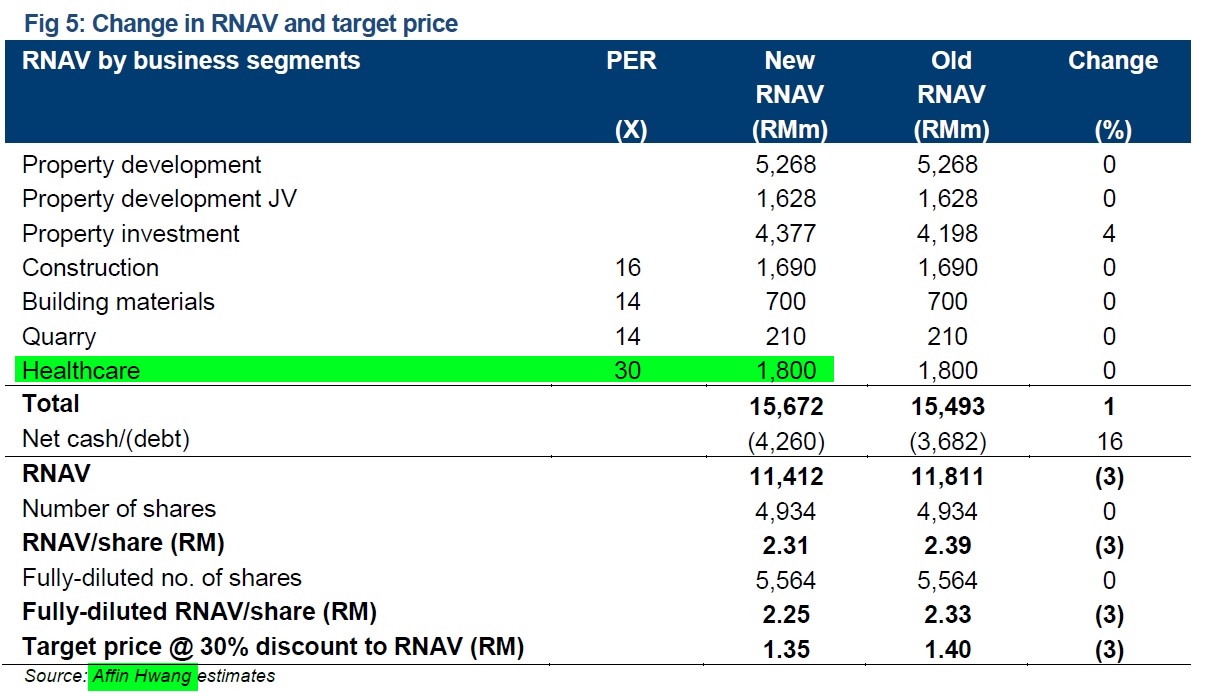

Affin Hwang IB: RM1,800 mil

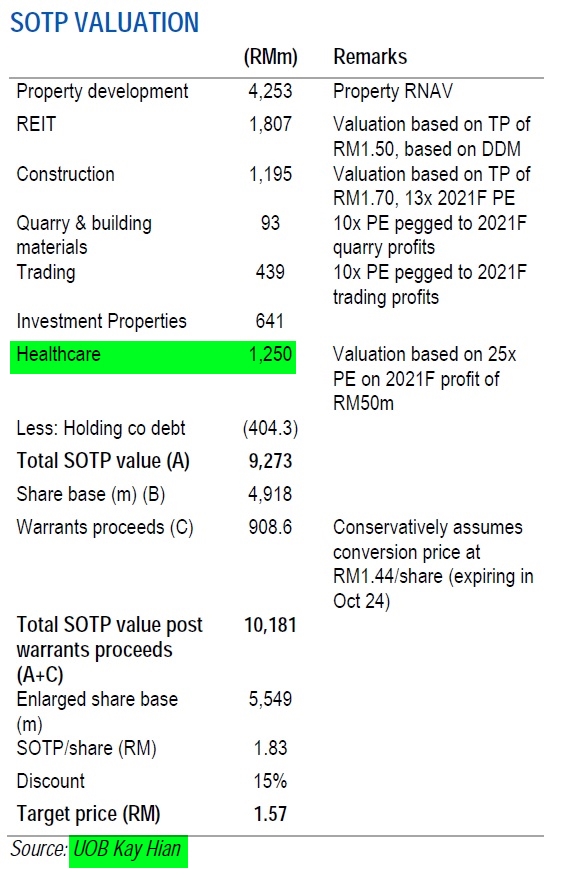

UOB Kay Hian: RM1,250 mil

(See pics at bottom)

Among the four above, Affin Hwang gave the highest valuation of RM1.8 bil.

However, using that USD1 bil (RM4.15 bil) valuation, that’s still a surplus of RM2.35 bil or 42 sen per share (based on fully diluted no. of shares).

42 sen is equivalent to 30% of Sunway’s share price of RM1.40.

The research houses are valuing using the price-to-earnings method. If valued based on the number of hospital beds, Sunway’s heathcare business should fetch a higher valuation (read: https://www.theedgemarkets.com/article/unlocking-value-healthcare-business)

From research reports dated 26 Aug 2020:

Join my Telegram channel for random updates @worthystocks

#SUNWAY

Comments

Post a Comment