KARYON (0054), another under the radar Covid-19 play [$$bill]

KARYON (0054), another under the radar Covid-19 play [$$bill]

Shopping at MR.DIY gave me an interesting stock idea - Karyon Industries Bhd.

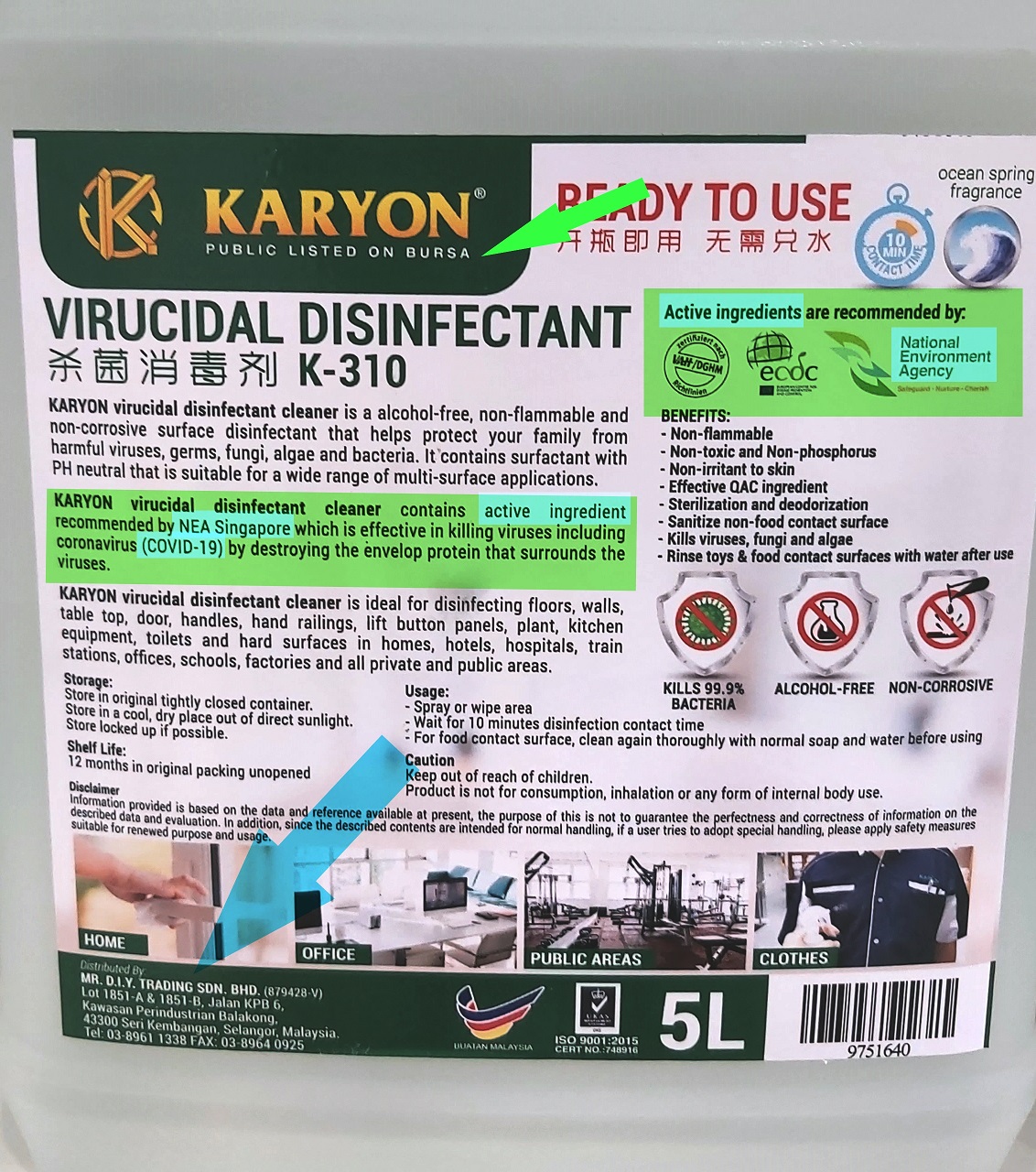

I noticed disinfectants on the shelves and took a closer look:

Taking another closer look, the bottom of the logo stated “PUBLIC LISTED ON BURSA”.

So this got me wondering if Karyon is another Covid-19 thematic stock which is still under the radar of most investors, as was with RGTBHD (see my previous blog posts below).

- RGTBHD (9954), the newly discovered Covid-19 thematic play [$$bill]

- RGT Bhd (RGTBHD 9554), riding on sanitiser dispenser demand caused by Covid-19 [$$bill]

The disinfectants are being sold in two versions: Ready-To-Use and Concentrate.

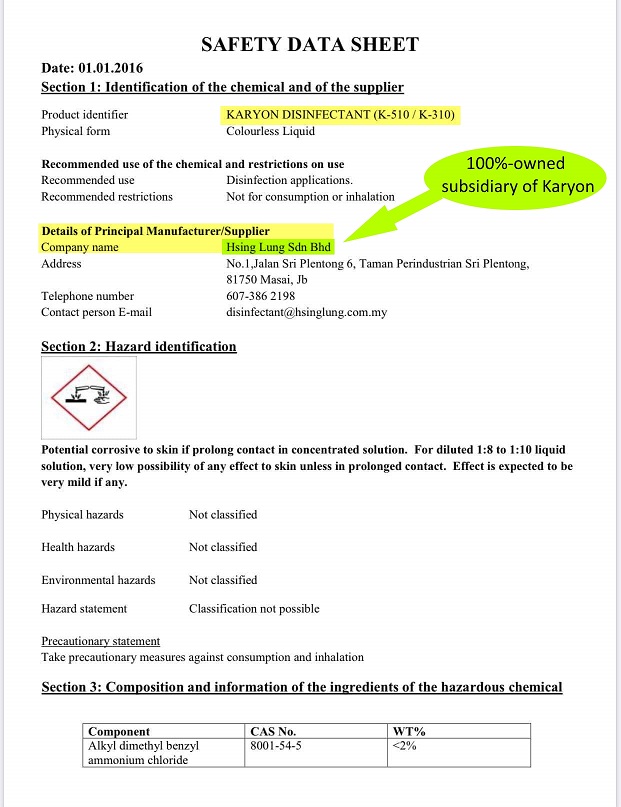

The active ingredients are recommended by agencies including The European Centre for Disease Prevention (ECDC) and Control and The National Environment Agency (NEA) of Singapore.

MR. D.I.Y. Trading Sdn Bhd is listed as the distributor on this label and they are selling the products online too. But these disinfectants are also directly sold on sites such as Lazada and Shopee.

Fundamentally decent

Financially, the company is decent based on its recently released financial year ended 31 Mar 2020 (FY20) results

Balance sheet is strong with RM41.7mil in cash against total borrowings of RM8.2mil. This puts it in a net cash position of RM33.5mil, which is 39% of its RM86mil market cap (475.7mil shares at 18sen share price).

Strong operating cash flow of RM15mil in FY20.

The company has been paying dividends in the past 10 years and more. Total dividends in FY20 was 0.45 sen.

Karyon’s track record in the past 10 years seems decent as well. A summary of their track record can be seen on YAPSS YouTube channel which featured Karyon early this year:

Karyon Industries Berhad (KLSE) #RTable - CashRich Series

https://www.youtube.com/watch?v=aecrOoU0720

Moving forward, Karyon would be an interesting stock to monitor.

Join my Telegram channel for updates @worthystocks

#KARYON

Appendix:

Join my Telegram channel for updates @worthystocks

#KARYON

Comments

Post a Comment