SCOMNET - No worries, growth is intact! [$$bill]

SCOMNET - No worries, growth is intact! [$$bill]

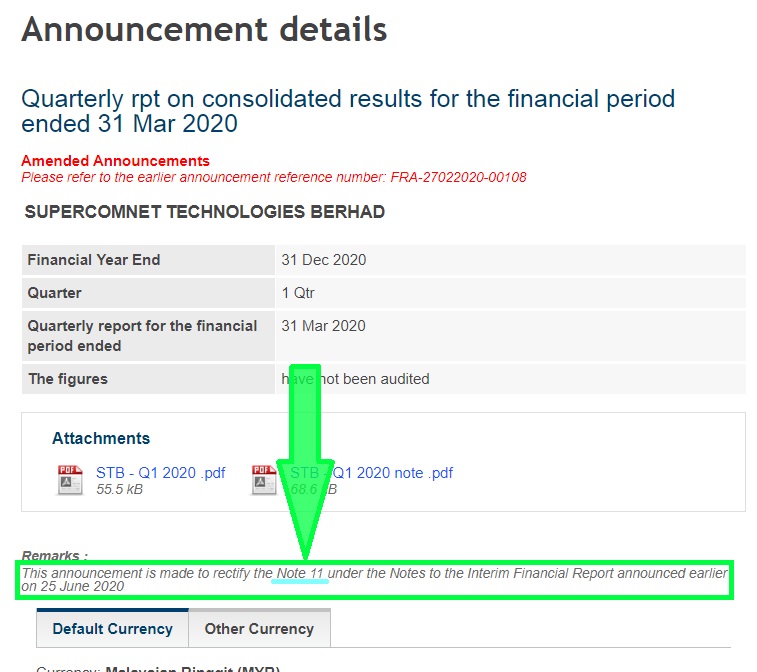

Supercomnet Technologies Bhd (Scomnet) recently spooked the market after it released its Q1 report on 25 June.

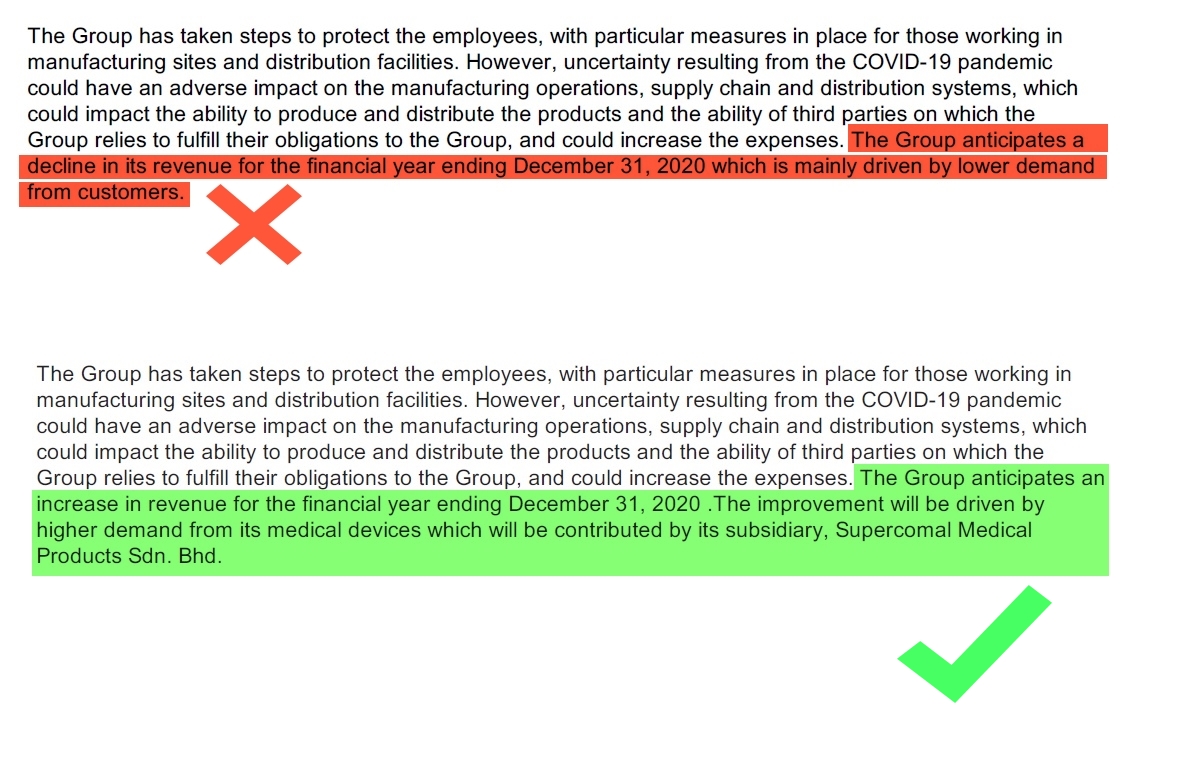

Investors became worried of its growth story after reading its Q1 financials notes which mentioned it anticipated revenue to decline this year.

However, that turned out to be an inaccurate statement. Scomnet released an amended announcement on 30 June.

The company clarified that it actually anticipates growth in 2020:

Scoment was probably referring to its traditional cable business when it mentioned that revenue would be lower.

To me, Scomnet is a multiyear healthcare growth stock. It’s attractive also because there are not many heathcare stocks in the region that produces unique high-value medical products.

Growth will be driven by its two main customers: US-listed Edwards Lifesciences Corp and Denmark-listed Ambu.

To put in perspective, Edward Lifesciences is a company with a market cap of US$42 bil (RM180 bil).

That market cap is larger than all the glove stocks in Malaysia combined… Top Glove (RM43bn), Hartalega (RM44bn), Kossan (RM11bn), Supermax (RM11bn) and so on.

Join my Telegram channel for updates @worthystocks

#SCOMNET

Comments

Post a Comment