RGTBHD (9954), the newly discovered Covid-19 thematic play [$$bill]

RGTBHD (9954), the newly discovered Covid-19 thematic play [$$bill]

Covid-19 has created a new normal with people now having to live a more hygienic lifestyle.

Companies around the world (shopping malls, offices, factories, etc.) are following suit with this new normal by installing hygiene care products such as sanitiser dispensers and hand soap dispensers.

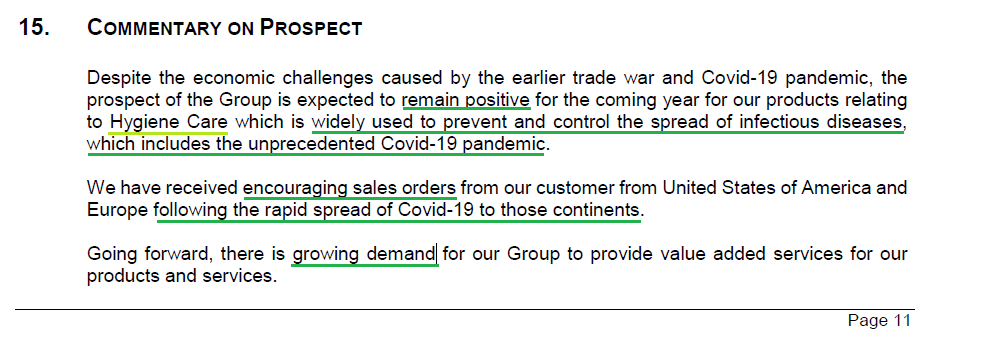

RGT Bhd (9954, not RGTECH) latest 3Q quarterly report (announced 19 May 2020) shows that it is set to benefit from this new normal:

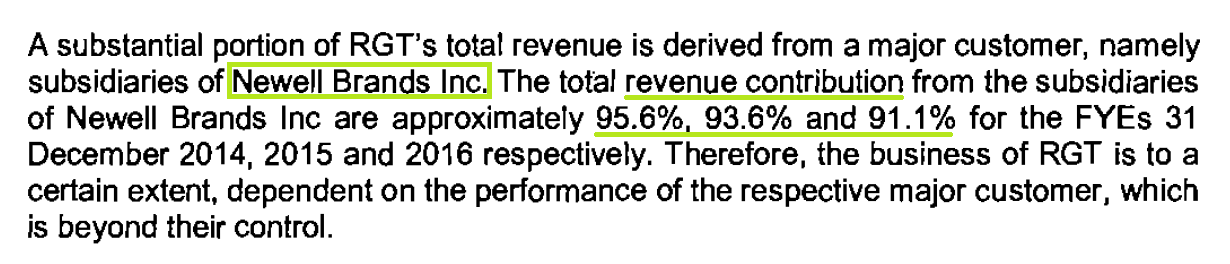

RGT Bhd’s Rapid Growth Technology Sdn Bhd is already an established front runner in these hygiene care products.

Rapid Growth Technology makes those products for its key customer Newell Brands Inc, which owns Rubbermaid Commercial Products:

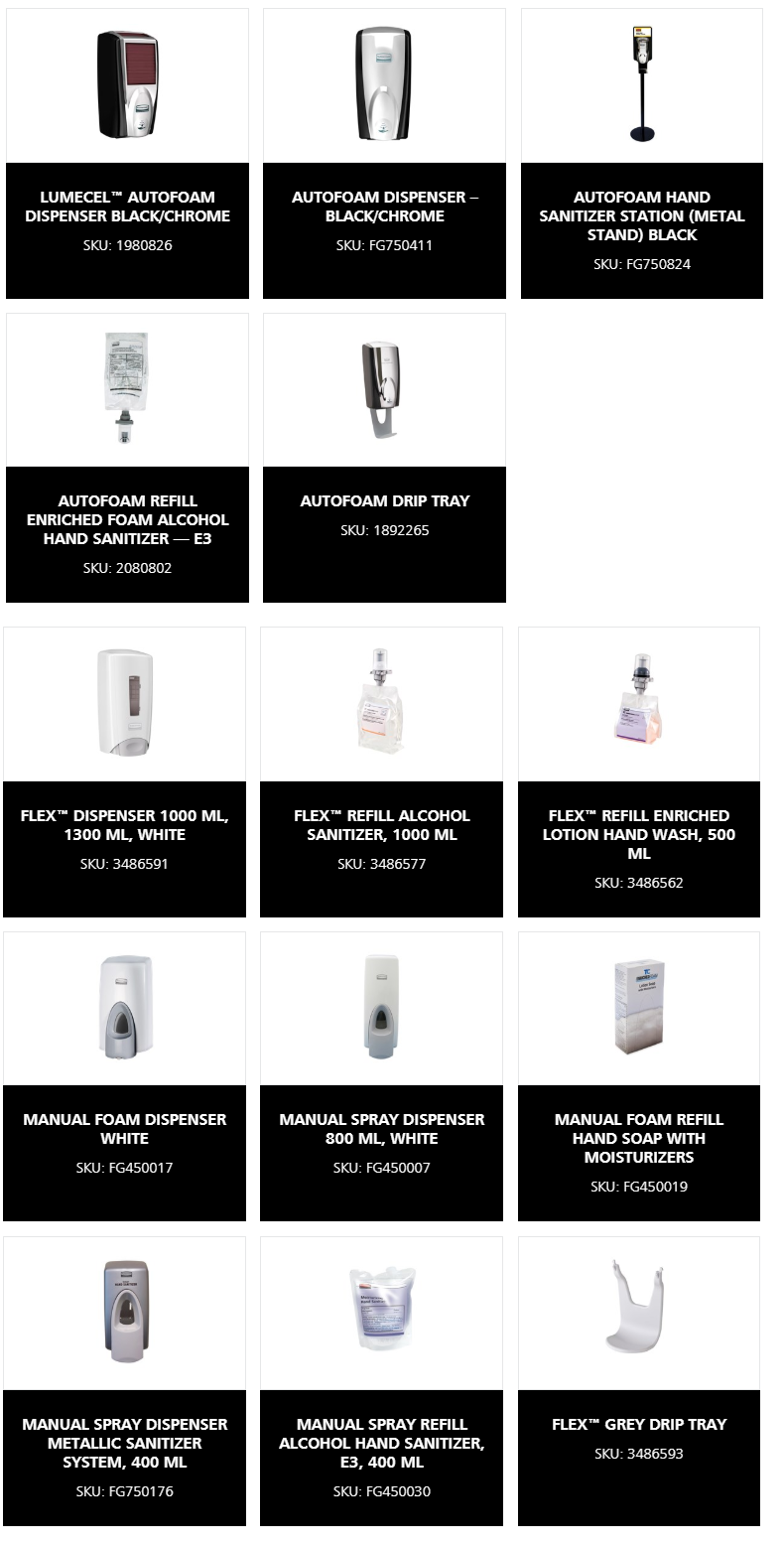

The hygiene care products that RGT makes:

See: https://www.rubbermaidcommercial.com/washroom/wall-mount-automatic-skin-care/

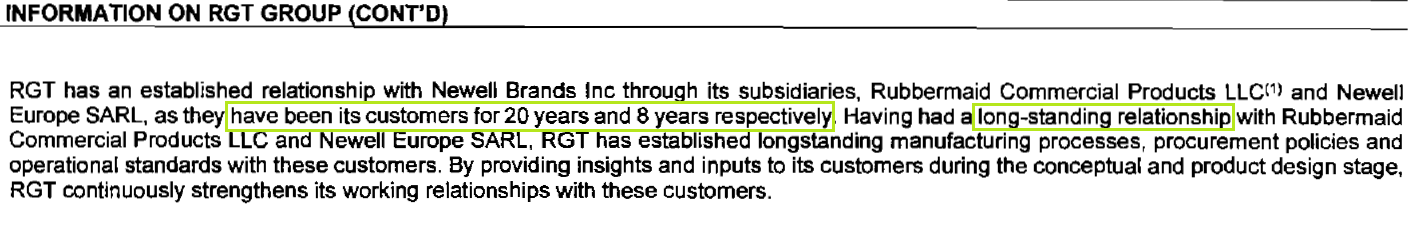

RGT has a good and long standing relationship with that key client.

RGT acquired 60% of Rapid Growth Technology in May 2018 and is currently in the final stages of acquiring the remaining 40% stake. This would allow RGT to fully consolidate the profits.

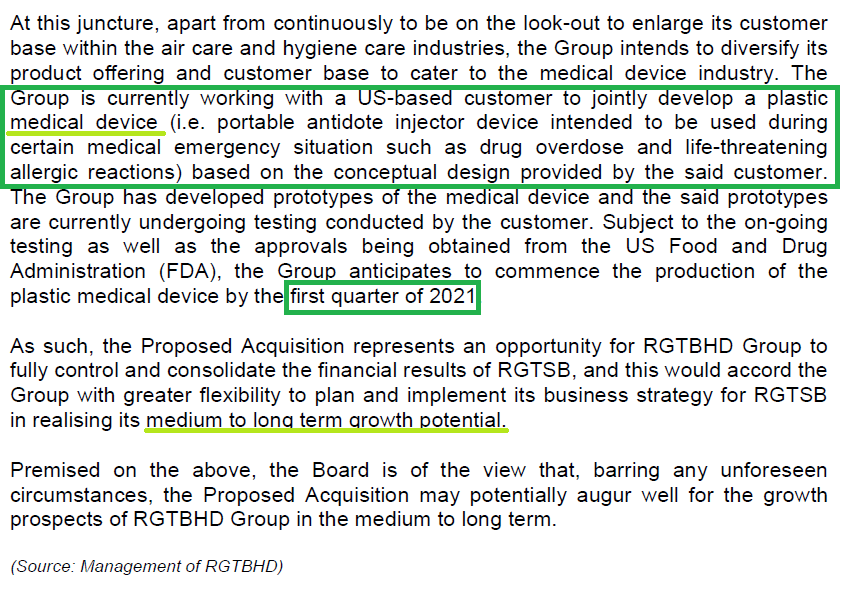

Medical devices

Another interesting angle with RGT is its venture into the medical device industry, a favourable and hot sector amid the current Covid-19 pandemic.

RGT looks ready to bank on these antidote injection devices for a US customer (Read: https://www.thestar.com.my/business/business-news/2019/11/25/rgt-to-spend-rm20mil-on-plant-expansion)

This somehow brings back memories of Supercomnet Technologies (Scomnet), which is now seeing good fortunes from its medical segment.

RGT’s capacity expansion into medical is in progress with its recent 57k sq ft land acquisition situated next to its existing factory in Bukit Mertajam, Penang (https://www.bursamalaysia.com/market_information/announcements/company_announcement/announcement_details?ann_id=3020091)

This should auger well for RGT's future growth.

Fundamentally decent

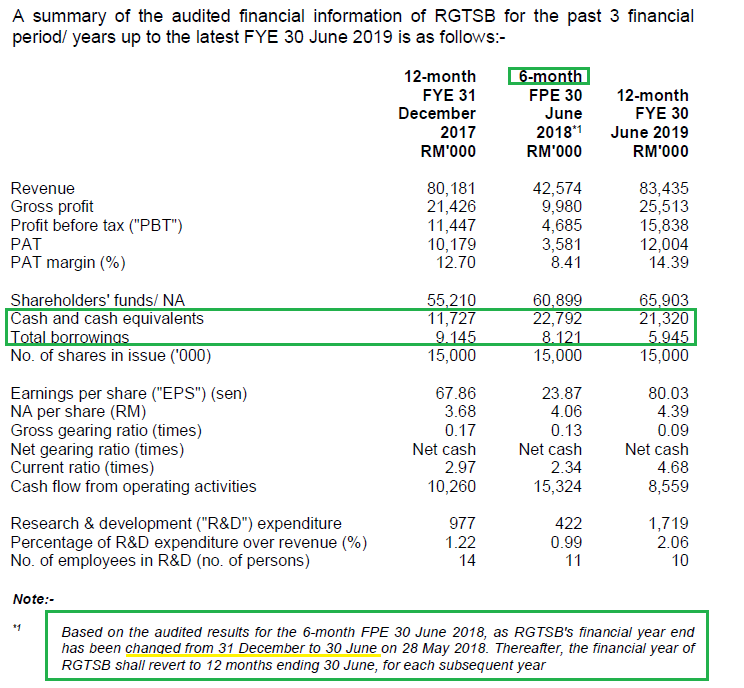

Rapid Growth Tech is actually quite a fundamentally sound company. In FY2019 ended June, it had strong balance sheet with RM21.3mil cash against RM5.95mil debt. Also, net profit margin and cash flow from operations are decent.

Likewise, RGT Bhd latest balance sheet is good too with cash of RM29.3mil and total borrowings of RM3.8mil. That’s a net cash of RM25.5mil which is attractive relative to its RM100+mil market cap.

All in all, RGT Bhd is an interesting stock to monitor especially amid the new normal.

Join my Telegram channel for updates @worthystocks

#RGTBHD

Comments

Post a Comment